1923 INFLATION (and UK 2023?)

In WWI, German had initially advanced their frontiers on both fronts. They believed it was safe to borrow extensively for the war effort, as any war debts could be paid off by requisitioning conquered factories and assets. This proved to be a false hope.

After defeat and the abdication of the Kaiser, the new Weimar Republic found itself heavily in debt and little means to make repayments as planned.

In addition, the Allies demanded huge reparations from Germany at the Treaty of Versailles, amounting to 132 billion gold marks.

From August 1921 the Reichsbank was forced to print more and more Marks to buy foreign currency for reparation installments.

In mid-1922, conferences were held with the foreign banks. There was no solution to the growing problem, so the Rechsbank's last resort was to print yet more Marks, further worsening the situation.

In late 1922, Germany was unable to make payments to France, so France then occupied the Saar, to take production and assets such as coal and steel. This loss of assets induced a further panic, and the Mark spiralled downwards.

In mid 1923, Germany devised a plan to create bonds linked to gold, denominated in gold marks. Gold Marks were used as a denomination for some revenue stamps, but never made their way onto postage stamps. Instead, a new currency called Rentenmark was indexed to these Gold Mark bonds, but carefully regulated. Both currencies circulated until mid 1924, but were used in different ways due to bank control, and at varying conversion rates and restrictions.

From 1st December 1923, the Rentenmark was used as the currency denomination for postage stamps.

The aftermath was that Germany regained a stable currency, and paid off the enormous war reparations. The bad side was that this amounted to about one third of the national deficit during 1920-1923, resulting in widespread poverty and hardship.

Also, from 1924 and beyond, many firms found themselves paying high taxes in "hard" Rentenmarks while their investments remained in old currency and not normally converted at the same rate. Therefore, many firms could not juggle enough and went bankrupt.

Hardships were compounded by the Great Crash of 1928. Popular feeling was that foreigners and German financiers had swindled savings from poor people and pensioners, foreclosed on mortgages, closed small businesses and taken away homes.

Unsurprisingly, these feelings were exploited by the Nazi Party during their early rise to power.

_________________________________________________

HISTORY MAY REPEAT ITSELF ?

Now let's play a little game with statistics and postage rates. Suppose we match UK £ with German Marks. To start :

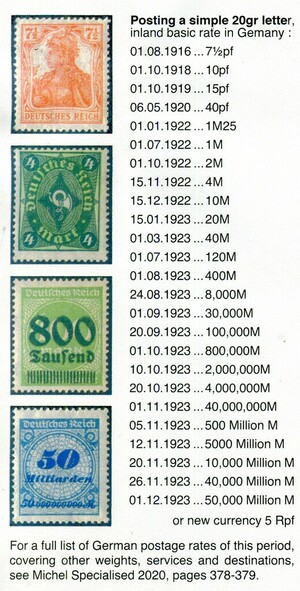

UK 1st class in 1975 = 7½p Germany 01.08.1916 = 7½pf

Then, for every year that UK rates increased, Germany had the same increase, but in roughly only a month, 1922/23.

So, UK 2023 1st class = £1.25 ; Germany 01.01.1922 = 1M25

Then, what will happen in 23 more UK years, as it actually happened in the consequent 23 months in Germany?

Germany in Dec 1923: 50,000,000,000 Marks, so maybe = UK £50,000,000,000 to post a letter in 23 years time (2046)?

The math may be a little shaky. Yes, "there are lies, damned lies, and statistics". The German disaster happened 100 years ago. But still food for thought for the UK?

- Published

- 13/10/23 10:30:00 AM